Planned Giving

Visit the V Foundation Legacy Site

Including the V Foundation for Cancer Research in your estate plans will help carry out the V Foundation’s vision to fund extraordinary cancer research and save more lives in the years to come. Research is transforming the prevention, detection and treatment of cancer like never before. But there is more work to do, and your legacy can make a difference.

Creating your charitable legacy with the V Foundation is easy! There are many ways to give, including naming the V Foundation in your will or trust. No matter how you choose to establish a planned gift with the V Foundation, your generosity will help us achieve victory over cancer.

Please let us know if you have already included the V Foundation in your estate plans. We would love the opportunity to thank you for your thoughtfulness.

For more information about planned giving at the V Foundation, please visit V Foundation Legacy or contact Kelly Climer at 919-443-3552 or [email protected].

Including the V Foundation in your estate plans is easy, but it might be hard to know where to start.

Here are a few next steps you can take:

- Talk with your financial advisor or attorney. Indicate that you wish to make a planned gift to the V Foundation.

- Contact the V Foundation’s Development staff. We are available to talk through options and answer questions on how your legacy can make a difference. Visit V Foundation Legacy or contact Kelly Climer at 919-443-3552 or [email protected].

- In your official documents, use the V Foundation’s legal name and Federal Tax ID number.

- the V Foundation for Cancer Research

- Federal Tax ID: 13-3705951

- Wills/Bequests

- Designate a specific dollar amount from your estate

- Designate a percentage of the total value of your estate

- Residual bequest – after all other beneficiary allocations are satisfied.

- Contingent bequest – The contingent is the beneficiary who will receive the benefit if the primary beneficiary has passed away

- Trusts

- Life insurance policy

- Beneficiary of a retirement or other financial account

If there are other estate planning vehicles you or your advisor are considering, we would be happy to discuss with you.

Donors Who Chose a Planned Gift

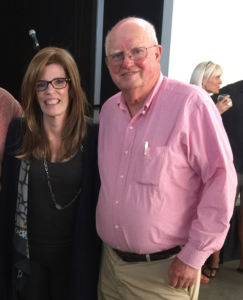

Frank S. Smith & Stephanie H. Smith: Building a Legacy

After witnessing the 1983 NC State University men’s basketball team win in the ACC Finals, rabid Wolfpack fans Stephanie Smith and her father, Frank, saw what it meant to strive for victory – to fight until the end.

In November 2016, Stephanie was diagnosed with pancreatic cancer, and she passed away in August 2017. Every day, she lived her life to the fullest, and her legacy continues at the V Foundation.

Frank and Stephanie decided to establish their charitable legacy by including the V Foundation in their estate plans. By listing the Foundation as beneficiary of their life insurance policies, their contribution created the Frank S. Smith and Stephanie H. Smith Fund and was made in honor of the Smith’s love for Jim Valvano. Their Fund has become the way Stephanie continues to bring people together with a mission to stop cancer.